What is e-Invoicing Under GST? Applicability, Limit, Rules & Implementation Date

Switch Language

e-Invoicing under GST denotes electronic invoicing. Just like a GST-registered business use an e-way bill for transporting goods, certain GST-registered businesses must also generate an e invoice in India. Once a GST invoice or credit-debit note is authenticated by the GSTN-authorised Invoice Registration Portal, it becomes e-invoice. Learn all about the e-invoicing system, steps to generate e-invoices, and seamless way to manage with Clear e-Invoicing.

Key Takeaways-

- e-Invoice Threshold Limit: The limit for mandatory e-invoicing is for businesses with an annual turnover of over Rs.5 crore. This rule has been effective since August 1, 2023, as per GST Notification 10/2023.

- e-Invoice Time Limit: From April 1, 2025, businesses with an Annual Aggregate Turnover (AATO) of Rs.10 crore+ must upload e-invoices to the Invoice Registration Portal (IRP) within 30 days.

- It reduces the chances of fake GST invoices, allowing only genuine input tax credit claims.

What is e-Invoicing under GST?

‘e-Invoicing’ or ‘electronic invoicing’ is a system in which B2B invoices and a few other documents are authenticated electronically by GSTN for further use on the common e-invoicing portal. e-Invoicing does not imply the generation of invoices on the government portal but it means submitting an already generated standard invoice on a common e invoice portal. Thus, it automates multi-purpose reporting with a one-time input of invoice details.

In its 35th meeting held on June 21, 2019, the GST Council decided to implement a system of e-Invoicing. While it initially was implemented for large enterprises, it has now expanded to cover small businesses as well. e-Invoice information gets transferred from this portal to both the GST and the e-way bill portals in real-time. Therefore, it eliminates the need for manual data entry while filing GSTR-1 and generating part-A of the e-way bills.

Who must Generate an e Invoice?

The e invoice applicability is based on the aggregate annual turnover (AATO) in a financial year for the taxpayer. Threshold for e-invoicing is as follows-

Turnover criteria or e Invoice limit-

| Phase | Applicable to taxpayers having an aggregate turnover of more than | Applicable from | Notification number |

| I | Rs 500 crore | 01.10.2020 | 61/2020 – Central Tax and 70/2020 – Central Tax |

| II | Rs 100 crore | 01.01.2021 | 88/2020 - Central Tax |

| III | Rs 50 crore | 01.04.2021 | 5/2021 - Central Tax |

| IV | Rs 20 crore | 01.04.2022 | 1/2022 - Central Tax |

| V | Rs 10 crore | 01.10.2022 | 17/2022 – Central Tax |

| VI | Rs 5 crore | 01.08.2023 | 10/2023 - Central Tax |

If the turnover in the last FY was below the threshold limit, but it increased beyond the threshold limit in the current year, then e-Invoicing would apply from the beginning of the next financial year. For example, taxpayers must comply with e-invoicing in FY 2025-26 and onwards if their Annual Aggregate Turnover (AATO) exceeds the specified limit in any financial year 2024-25. The aggregate turnover will include the turnover of all GSTINs under a single PAN across India.

Watch the video below to understand about e-invoicing implementation for your enterprise-

Where to Generate e-Invoices?

The CBIC notified a set of common portals to prepare an e invoice via Notification No.69/2019 – Central Tax.

Under the electronic invoicing system, an identification number will be issued against every invoice by the Invoice Registration Portal (IRP), managed by the GST Network (GSTN). There are a total of 6 IRPs. The National Informatics Centre (NIC) launched the first IRP at einvoice1.gst.gov.in. Most recently, it launched einvoice2.gst.gov.in. The other empanelled IRPs are Cygnet Infotech Private Limited, Clear (Defmacro Software Private Limited), Ernst & Young LLP and IRIS Business Services Limited.

Transactions & Documents in e-Invoicing

The following transactions and documents listed below fall under e invoicing applicability-

| Documents | Transactions |

| Tax invoices, credit notes and debit notes under Section 34 of the CGST Act | Taxable Business-to-Business sale of goods or services, Business-to-government sale of goods or services, exports, deemed exports, supplies to SEZ (with or without tax payment), stock transfers or supply of services to distinct persons, SEZ developers, and supplies under reverse charge covered by Section 9(3) of the CGST Act. |

Exclusions from e-Invoicing

However, irrespective of the turnover, e-Invoicing shall not be applicable to the following categories of registered persons for now, as notified in CBIC Notification No.13/2020 – Central Tax, amended from time to time-

| Notified Businesses | Documents | Transactions |

| 1)An insurer, a banking company or a financial institution, including an NBFC 2) A Goods Transport Agency (GTA) 3) A registered person supplying passenger transportation services 4) A registered person supplying services by way of admission to the exhibition of cinematographic films in multiplex services 5) An SEZ unit (excluded via CBIC Notification No. 61/2020 – Central Tax) 6) A government department and Local authority (excluded via CBIC Notification No. 23/2021 – Central Tax) 7) Persons registered in terms of Rule 14 of CGST Rules (OIDAR) | Delivery challans, Bill of supply, financial or commercial credit note or debit note, bill of entry, and ISD invoices. | Any Business-to-Consumers (B2C) sales, Nil-rated or non-taxable or exempt B2B sale of goods or services, nil-rated or non-taxable or exempt B2G sale of goods or services, imports, high sea sales and bonded warehouse sales, Free Trade & Warehousing Zones (FTWZ), and supplies under reverse charge covered by Section 9(4) of the CGST Act. |

Time Limit to Generate e-Invoice

As per the 5th November 2024 advisory issued on the GSTN portal, the time limit of 30 days for reporting e-Invoices on IRP portals has been extended for taxpayers with an AATO of Rs.10 crore and above. To provide sufficient time for taxpayers to comply with this requirement, the changes would come into effect from 1st April 2025 onwards.

Below is a timeline of developments in fixing the time-limit to generate e-invoices-

Period | e-Invoice Reporting Requirement | Applicability (AATO Threshold) |

Till Apr 30, 2023 | No fixed time limit for generating/reporting e-invoices | All taxpayers under e-invoicing |

May 1, 2023 – Oct 31, 2023 | Govt announced 7-day time limit (but rule was not implemented) | Targeted at AATO ≥ Rs.100 crore (kept in abeyance) |

From Nov 1, 2023 onwards | Mandatory reporting of documents to IRP within 30 days | AATO ≥ Rs.100 crore; extended to AATO ≥ Rs.10 crore from 1 Apr 2025 |

Process of Getting an e invoice

Under the e-invoicing system, the process of generating and uploading invoice details will remain the same. It’s done by importing using the Excel tool/JSON or via API integration, either directly or through a GST Suvidha Provider (GSP). The data will seamlessly flow for GSTR-1 preparation and for the e-way bill generation too. The e-invoicing system will be the key tool to enable this.

The following are the stages involved in implementing e-invoicing for generating or raising an e-invoice-

Step 1: Reconfigure ERP for e-invoicing format

The taxpayer has to ensure the use of the reconfigured ERP system as per PEPPOL standards. He can coordinate with any software service providers to incorporate the standard set for e-invoicing, i.e. e invoice schema (standards) and must have the mandatory parameters notified by the CBIC.

Step 2: Choosing IRN generation method

Any taxpayer has primarily two options for IRN generation:

- The IP address of the computer system can be whitelisted on the e-invoice portal for a direct API integration or integration via GST Suvidha Provider (GSP) such as ClearTax.

- Download the bulk generation tool to bulk upload invoices. It will generate a JSON file that can be uploaded to the e invoice portal to generate IRNs in bulk.

Step 3: Feed the invoice details into IRP

Once either of the above options is chosen, raise the invoice on the respective ERP software or billing software. Team must give all the necessary details like billing name and address, GSTN of the supplier, transaction value, item rate, GST rate applicable, tax amount, etc. All taxpayers, irrespective of turnover, should mandatorily use 2FA for e-invoice and e-way bill generation from 1st April 2025.

Thereafter, upload the details of the invoice, especially mandatory fields, onto the IRP using the JSON file or via an application service provider (app or through GSP) or through direct API. The IRP will act as the central registrar for e-invoicing and its authentication. There are several other modes of interacting with IRP, such as SMS-based and mobile app-based.

Step 4: IRP validation on invoice

IRP will validate the key details of the B2B invoice, check for any duplications and generate an invoice reference number (hash) for reference. There are four parameters based on which IRN is generated: Seller GSTIN, invoice number, FY in YYYY-YY, and document type (INV/DN/CN).

IRP generates the invoice reference number (IRN), digitally signs the invoice and creates a QR code in the Output JSON for the supplier. On the other hand, the seller of the supply will get intimated about the e invoice generation through email (if provided in the invoice).

Step 5: Passing on the e-invoice details

IRP will send the authenticated payload to the GST portal for GST returns. Additionally, details will be forwarded to the e-way bill portal, if applicable. The GSTR-1 of the seller gets auto-filled for the relevant tax period. In turn, it determines the tax liability.

A taxpayer can continue to print their invoice as is presently done with a logo. The e-invoicing system only mandates that all taxpayers report invoices on IRP in electronic format. You can follow this step-by-step guide to understand the detailed process of generating an e-invoice.

Benefits of e-Invoicing to Businesses

Businesses will have the following benefits by using e-invoice initiated by GSTN-

- e-Invoice resolves and plugs a major gap in data reconciliation under GST to reduce mismatch errors.

- e-Invoices created on one software can be read by another, allowing interoperability and helping reduce data entry errors.

- Real-time tracking of invoices prepared by the supplier is enabled by e invoice.

- Backward integration and automation of the GST return filing process – the relevant details of the invoices would be auto-populated in the various returns, especially for generating part-A of e-way bills.

- Faster availability of genuine input tax credit.

- Lesser possibility of audits/surveys by the tax authorities since the information they require is available at a transaction level.

- Faster and easier access to formal credit routes, such as invoice discounting or financing, especially for small businesses.

- Improved customer relations and growth in prospects for small businesses to do business with large enterprises.

How can e-Invoicing Curb Tax Evasion?

It will help in curbing tax evasion in the following ways-

- Tax authorities will have access to transactions as they take place in real-time since the e invoice will have to be compulsorily generated through the GST portal.

- There will be less scope for manipulating invoices since the invoice gets generated before carrying out a transaction.

- It will reduce the chances of fake GST invoices, and only genuine input tax credit can be claimed, as all invoices need to be generated through the GST portal. Since the input credit can be matched with output tax details, it becomes easier for GSTN to track fake tax credit claims.

What are the Mandatory Fields of an e-Invoice?

e-Invoice must primarily adhere to the GST invoicing rules. Apart from this, it should also accommodate the invoicing system or policies followed by each industry or sector in India. Certain information is made mandatory, whereas the rest of it is optional for businesses. Many fields are also made optional, and users can choose to fill in only relevant fields.

Below is the gist of the contents of the latest e-invoice format as notified on 30th July 2020 via Notification No.60/2020 – Central Tax:

- 12 sections (mandatory + optional) and six annexures consisting of a total of 138 fields.

- Out of the 12 sections, five are mandatory, and seven are optional. Two annexures are mandatory.

- The five mandatory sections are basic details, supplier information, recipient information, invoice item details, and document total. The two mandatory annexures are details of the items and the document total.

There are 30 fields compulsory to declare in an e-invoice. Some of them are given below-

| Sl. no. | Name of the field | List of choices/ specifications/sample Inputs | Remarks |

| 1 | Document Type Code | Enumerated List, such as INV/CRN/DBN | Type of document must be specified |

| 2 | Supplier_Legal Name | String Max length: 100 | Legal name of the supplier must be as per the PAN card |

| 3 | Supplier_GSTIN | Max length: 15 Must be alphanumeric | GSTIN of the supplier raising the e-invoice |

| 4 | Supplier_Address | Max length: 100 | Building/Flat no., Road/Street, Locality, etc. of the supplier raising the e-invoice |

| 5 | Supplier_Place | Max length: 50 | Supplier’s location such as city/town/village must be mentioned |

| 6 | Supplier_State_Code | Enumerated list of states | The state must be selected from the latest list given by GSTN |

| 7 | Supplier Pincode | Six digit code | The place (locality/district/state) of the supplier’s locality |

| 8 | Document Number | Max length: 16 Sample can be “ Sa/1/2019” | For unique identification of the invoice, a sequential number is required within the business context, time frame, operating systems and records of the supplier. No identification scheme is to be used. |

| 9 | Preceeding_Invoice_Reference and date | Max length:16 Sample input is “ Sa/1/2019” and “16/11/2020” | Detail of original invoice which is being amended by a subsequent document such as a debit and credit note. It is required to keep future expansion of e-versions of credit notes, debit notes and other documents required under GST. |

| 10 | Document Date | String (DD/MM/YYYY) as per the technical field specification | The date when the invoice was issued. However, the format under explanatory notes refers to ‘YYYY-MM-DD’. Further clarity will be required. Document period start and end date must also be specified if selected. |

It has also described every field along with the sample inputs for the interested users. One can see that certain required fields from the e-way bill format are included now in the e-invoice, such as the sub-supply type.

With effect from 1st June 2025, the Invoice Reporting Portal (IRP) will treat invoice/document numbers as case-insensitive while generating e-invoices. The portal will automatically convert the invoice numbers reported in any format to uppercase before IRN generation. Also, IRP clarified that this change aligns with the treatment of invoice numbers in GSTR-1.

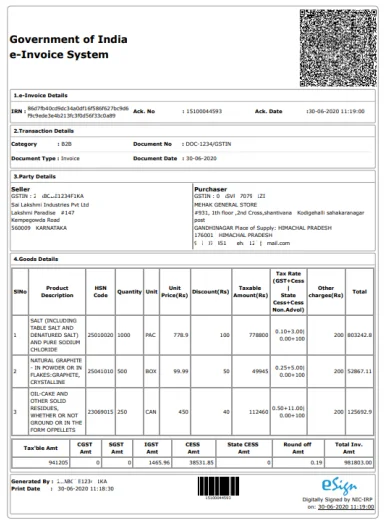

Format of Sample e-Invoice

The notified e-invoice format is as follows:

How does Clear e-Invoicing Help?

Team Clear provides the best-in-class e-invoicing solution for businesses.

Clear is officially a GSTN-approved IRP. More than 3,000 large enterprises trust the Clear e-Invoicing solution for a unified e-invoicing and e-way bill compliance journey. We provide the best-in-class e-invoicing solution for businesses of any scale and industry. Do not miss exploring the Clear e-Invoicing solution! Team Clear ensures a safe migration to an upgraded UI with no changes to your historical data.

Team Clear also offers various modes through which e-invoices can be generated by the taxpayers, such as seamless API integrations, Excel mode, FTP, SFTP or Tally connector. The user can enjoy numerous value additions such as-

- Seamless generation of 5,000 e-invoices per minute

- Integration with a high-fidelity solution with 99.99% uptime

- 100+ data validations to ensure an error-free smooth e-invoicing experience

- Auto-retry of failed EWBs (with distance error) to improve the success rate of EWB generation

- Automatic generation of the e-way bill after IRN generation without any ingestion of data

- Faster loading of ‘e-invoices’ and ‘e-way bills’ on the screen for as many as 1 lakh documents

- Reconciliation vis-a-vis e-way bill and GSTR-1 data, insightful reports, customised print template for e-invoice, data archiving, etc.