What is E-Way Bill: Rules, Applicability, Limit, Requirement & Generation Process Explained

Managing a seamless movement of goods for your enterprise while also ensuring compliance regulations can be challenging for your teams. As a finance leader, you might see your teams face numerous hurdles, including paperwork delays and confusion about transportation rules. This is where the e-way Bill system under GST streamlines the movement of goods under India's GST framework. It ensures every consignment is properly documented, making the entire process transparent and hassle-free. But what exactly is an E-way Bill, and how does it work?

E-Way Bill or an Electronic Way bill is required for movement of goods under GST. Transporters should carry an e-Way Bill when moving goods from one place to another, valid across India if value of consignment exceeds a specified limit.

Latest Updates

June 16, 2025

The NIC is launching a 2nd e-way bill portal https://ewaybill2.gst.gov.in/ from 1st July 2025, as per the GSTN's advisory dated 16th June 2025. The move is to eliminate dependency on a single portal and ensure real-time synchronisation of data. It means the E-Way Bill2 portal is designed to synchronise e-way bill details with the main portal within a few seconds.

What is an E-Way Bill?

Under GST, an Electronic Way bill is required for movement of goods. A registered person cannot transport goods in a vehicle whose value exceeds Rs. 50,000 (Single Invoice/bill/delivery challan) without an e-way bill that is generated on ewaybillgst.gov.in.

Alternatively, E-way bill can also be generated or cancelled through SMS, Android App and by site-to-site integration through API entering the correct GSTIN of parties. Validate the GSTIN with the help of the GST search tool before using it. When an e-way bill is generated, a unique E-way Bill Number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

What are the Components of an E-Way Bill?

E-Way bill is divided into two components i.e. Part A and Part B. The person required to issue eway bill should fill in the following details of Part A:

- Details of GSTIN of recipient,

- Place of delivery (PIN Code),

- Invoice or challan number and date,

- Value of goods,

- HSN code,

- Transport document number (Goods Receipt Number or Railway Receipt Number or Airway Bill Number or Bill of Lading Number) and

- Reasons for transportation

While as far as Part B is concerned, it comprises of the transporter details (for eg: Vehicle number)

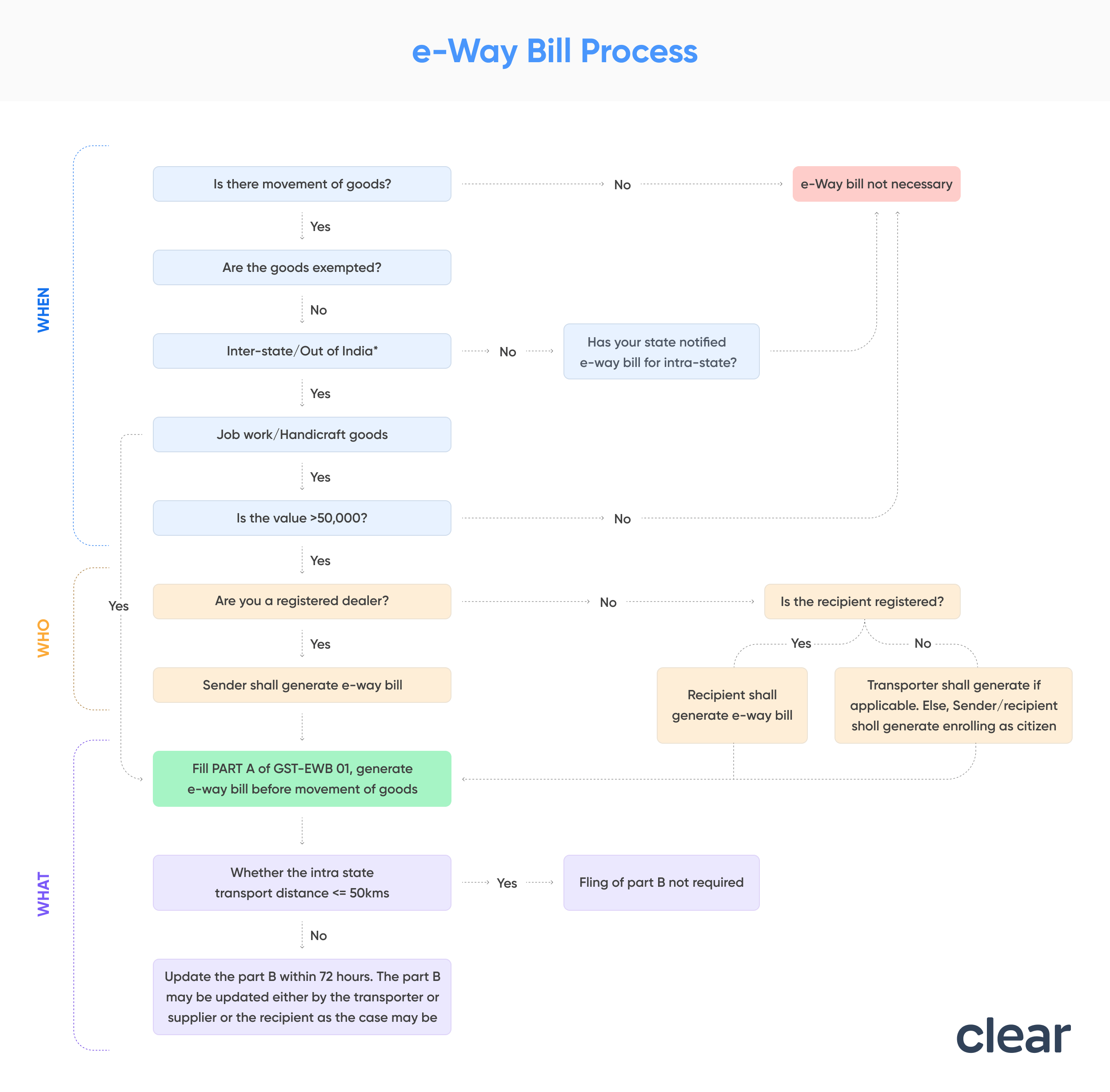

When Should E-Way Bill be Issued?

eWay bill will be generated when there is a movement of goods in a vehicle/ conveyance of value more than Rs. 50,000 (either each Invoice or in aggregate of all invoices in a vehicle/conveyance) –

- In relation to a ‘supply’

- For reasons other than a ‘supply’ ( say a return)

- Due to inward ‘supply’ from an unregistered person

For this purpose, a supply may be either of the following:

- A supply made for a consideration (payment) in the course of business

- A supply made for a consideration (payment) which may not be in the course of business

- A supply without consideration (without payment) In simpler terms, the term ‘supply’ usually means a:

- Sale – sale of goods and payment made

- Transfer – branch transfers for instance

- Barter/Exchange – where the payment is by goods instead of in money

Therefore, e-Way Bills must be generated on the common portal for all these types of movements. For certain specified Goods, the e-way bill needs to be generated mandatorily even if the value of the consignment of Goods is less than Rs. 50,000:

- Inter-State movement of Goods by the Principal to the Job-worker by Principal/ registered Job-worker

- Inter-State Transport of Handicraft goods by a dealer exempted from GST registration

*Generate e-way bill irrespective of the value of consignment.

Who should Generate an E-Way Bill?

- Registered Person – Eway bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a registered person. A registered person or the transporter may choose to generate and carry eway bill even if the value of goods is less than Rs 50,000.

- Unregistered Persons – Unregistered persons are also required to generate e-Way Bill. However, where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the supplier.

- Transporter – Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill but are not required to generate the Eway bill (as Form EWB-01 or EWB-02) where all the consignments in the conveyance :

- Individually (single Document**) is less than or equal to Rs 50,000 BUT

- In Aggregate (all documents** put together) exceeds Rs 50,000

**Document means Tax Invoice/Delivery challan/Bill of supply

Unregistered Transporters will be issued Transporter ID on enrolling on the e-way bill portal after which Eway bills can be generated.

| Who | When | Part | Form |

| Every Registered person under GST | Before movement of goods | Fill Part A | Form GST EWB-01 |

| Registered person is consignor or consignee (mode of transport may be owned or hired) OR is recipient of goods | Before movement of goods | Fill Part B | Form GST EWB-01 |

| Registered person is consignor or consignee and goods are handed over to transporter of goods | Before movement of goods | Fill Part B | The registered person shall furnish the information relating to the transporter in Part B of FORM GST EWB-01 |

| Transporter of goods | Before movement of goods | -- | Generate e-way bill on basis of information shared by the registered person in Part A of FORM GST EWB-01 |

| An unregistered person under GST and recipient is registered | Compliance to be done by Recipient as if he is the Supplier. | -- | 1. If the goods are transported for a distance of fifty kilometers or less, within the same State/Union territory from the place of business of the consignor to the place of business of the transporter for further transportation, the supplier or the transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01. 2. If supply is made by air, ship or railways, then the information in Part A of FORM GST EWB-01 has to be filled in by the consignor or the recipient |

Note: If a transporter is transporting multiple consignments in a single conveyance, they can use the form GST EWB-02 to produce a consolidated e-way bill, by providing the e-way bill numbers of each consignment. If both the consignor and the consignee have not created an e-way bill, then the transporter can do so by filling out PART A of FORM GST EWB-01 on the basis of the invoice/bill of supply/delivery challan given to them.

Cases when E-Way Bill is Not Required

In the following cases it is not necessary to generate e-Way Bill:

- The mode of transport is non-motor vehicle

- Goods transported from Customs port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

- Goods transported under Customs supervision or under customs seal

- Goods transported under Customs Bond from ICD to Customs port or from one custom station to another.

- Transit cargo transported to or from Nepal or Bhutan

- Movement of goods caused by defence formation under Ministry of defence as a consignor or consignee

- Empty Cargo containers are being transported

- Consignor transporting goods to or from between place of business and a weighbridge for weighment at a distance of 20 kms, accompanied by a Delivery challan.

- Goods being transported by rail where the Consignor of goods is the Central Government, State Governments or a local authority.

- Goods specified as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

- Transport of certain specified goods- Includes the list of exempt supply of goods, Annexure to Rule 138(14), goods treated as no supply as per Schedule III, Certain schedule to Central tax Rate notifications. (PDF of List of Goods).

Note: Part B of e-Way Bill is not required to be filled where the distance between the consigner or consignee and the transporter is less than 50 Kms and transport is within the same state.

State-wise E-Way Bill Rules and Limits

Inter-State movement of goods has seen rise in numbers of generation of e-way bills ever since its implementation began from 1st April 2018. State-wise e-way bill rules has differed and changed from time-to-time. Many States and Union Territories also joined the league in the generation of e-way bills for movement of goods within the State/UT.

However, reliefs have been provided to people of few States by way of exempting them from eway bill generation in case of monetary limits falling below threshold amount or certain specified items. For Instance, Tamil Nadu has exempted people of its State from the generation of eway bill if the monetary limit of the items falls below Rs. One Lakh. To know more of such reliefs for other States/UTs, visit our page on state-wise e-way bill rules and threshold limits or alternatively check the respective commercial tax websites for each of such States/UTs.

How to Generate E-Way Bill on Portal

E-Way Bill and the e-way bill number can be generated on the e-Way Bill Portal 1 or e-Way Bill Portal 2 (from 1st July 2025). All you need is a Portal login. For a detailed step-by-step guide on e-Way Bill Generation check out our article – Guide to generate e-Way Bill online.

GST Network has issued an advisory on 17th December 2024 to expand the scope of mandating 2FA on NIC for taxpayers. If your enterprise/business have AATO over Rs.20 crores, use 2FA from 1st January 2025 mandatorily. Likewise, 2FA will be mandatory for businesses with turnover ranging Rs.5 Crore to Rs.20 Crore from 1st February 2025. All taxpayers irrespective of turnover should mandatorily use 2FA for e-invoice and e-way bill generation from 1st April 2025.

SMS E-Way Bill Generation on Mobile

You can generate e-way bills via SMS using registered mobile phone. All can begin by enabling SMS e-way bill generate facility. Register the mobile phone to be used for SMS facility of e-way bill generation. Thereafter, send simple SMS codes to a particular mobile number managed by the e-way bill portal/GSTN to generate, manage and cancel e-way bills. For more details, read our article on SMS mode of e-way bill generation

Time Limit to Generate E-Way Bill

Earlier there was no time limit set for generating e-way bills. However, there was a validity given for every e-way bill, explained in the next section. However, starting 1st January 2025, you can generate e-way bills on documents dated within 180 days. For example, documents dated earlier than 5th July 2024 will be ineligible for e-way bill generation from 1st January 2025. The update is as per a GSTN advisory dated 17th December 2024.

Validity of E-Way Bill

An e-way bill is valid for periods as listed below, which is based on the distance travelled by the goods. Validity is calculated from the date and time of generation of e-way bill-

| Type of conveyance | Distance | Validity of EWB |

Other than Over dimensional cargo | Less Than 200 Kms | 1 Day |

| For every additional 200 Kms or part thereof | additional 1 Day | |

For Over dimensional cargo | Less Than 20 Kms | 1 Day |

| For every additional 20 Kms or part thereof | additional 1 Day |

Validity of Eway bill can also be extended by the generator of such Eway bill either eight hours before expiry or within eight hours after its expiry.

e-Way bill validity extensions is capped at 360 days from the original generation date starting from 1st January 2025.

Documents or Details Required to Generate E-Way Bill

- Invoice/ Bill of Supply/ Challan related to the consignment of goods

- Transport by road – Transporter ID or Vehicle number

- Transport by rail, air, or ship – Transporter ID, Transport document number, and date on the document

Note: While in movement, a vehicle can be blocked by the proper officer for the verification of documents including the E-way bill or inspection of goods.

Read More: