Section 115BAC New Tax Regime 2026: Slabs, Deductions, Exemptions & Benefits

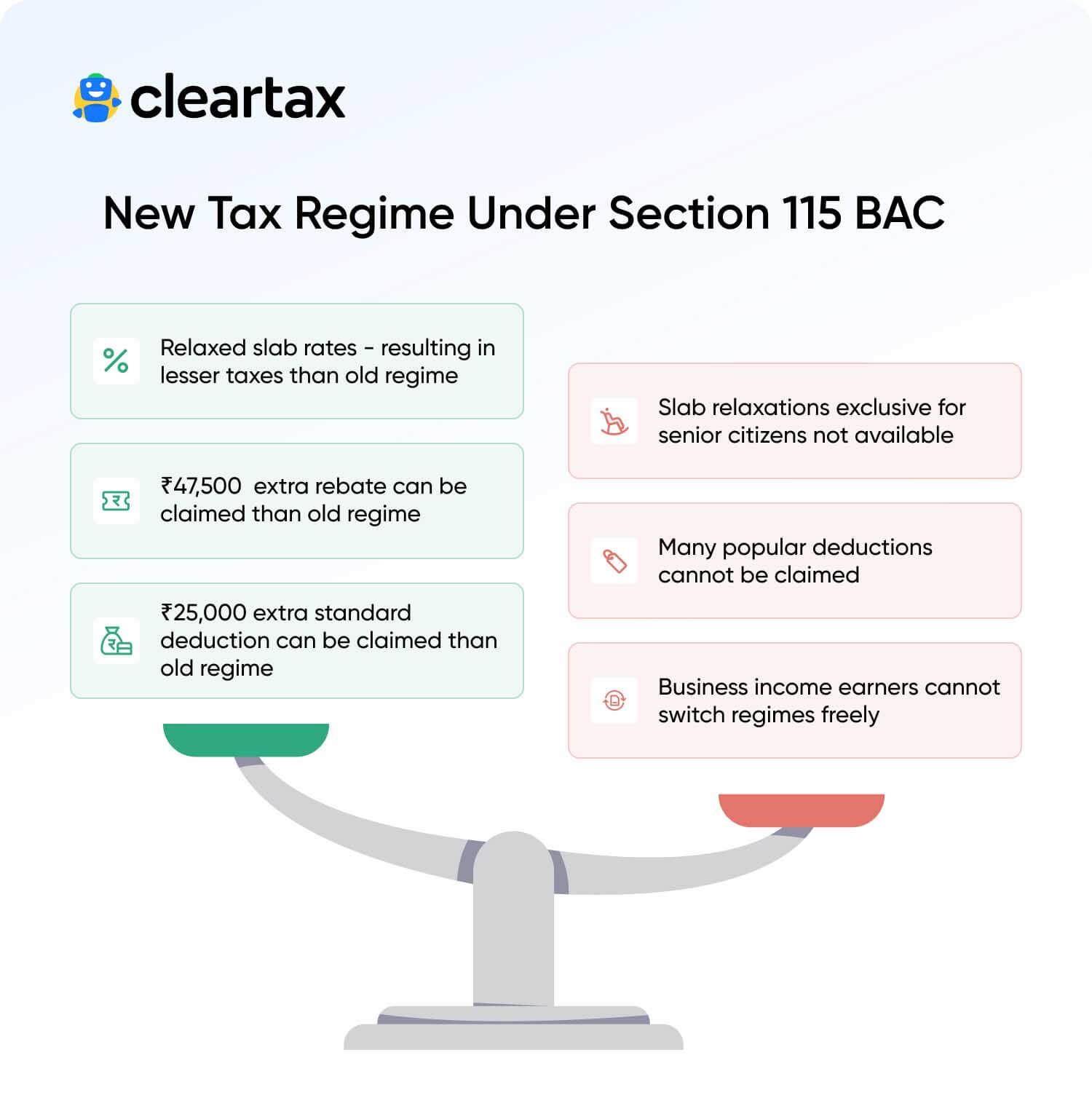

Section 115BAC of the Income Tax Act or the new tax regime, offers relaxed tax slab rates ensuring tax savings for the taxpayers. However, new tax regime does not allow various deductions & exemptions compared to the old tax regime. For FY 2025-26, the new tax regime is the default tax regime but taxpayers can still opt for old tax regime while filing ITR.

Key Highlights of the New Tax Regime

- Individuals and HUFs are eligible for the New Tax Regime.

- New Tax Regime offers a basic exemption of Rs. 4 lakh and a tax rebate of up to Rs. 60,000.

- Taxpayers enjoy tax-free income up to Rs. 12 lakh and salaried individuals enjoy tax-free income up to Rs. 12.75 lakhs.

- Deductions & Exemptions such as HRA, 80C, 80D and many more are not allowed.

Income Tax Slab Rates Under Section 115BAC

Under Section 115BAC, the new tax regime tax slabs for FY 2025-26 (AY 2026-27) are as follows:

| New Tax Slabs FY 2025-26 (AY 2026-27) | New Tax Rates FY 2025-26 (AY 2026-27) |

| Up to Rs. 4 lakh | Nil |

| Rs. 4 lakh to Rs. 8 lakh | 5% |

| Rs. 8 lakh to Rs. 12 lakh | 10% |

| Rs. 12 lakh to Rs. 16 lakh | 15% |

| Rs. 16 lakh to Rs. 20 lakh | 20% |

| Rs. 20 lakh to Rs. 24 lakh | 25% |

| Above Rs. 24 lakh | 30% |

The new tax regime offers a standard deduction of Rs. 75,000 to salaried individuals.

Rebate Under New Tax Regime

Resident taxpayers can pay zero tax if their taxable income is below certain income limits. A taxpayer opting for the new tax regime, is eligible for a tax rebate of up to Rs. 60,000. Therefore, under the new tax regime, taxable income of up to Rs. 12 lakh is tax-free with zero tax liability.

However, for salaried individuals the new tax regime offers tax-free income up to Rs. 12.75. This is due to the standard deduction available.

Section 115BAC Deductions & Exemptions Allowed

Under the New tax regime, you can claim only the following tax exemptions and deductions:

Chapter VI A Deductions

- Deduction for employer’s contribution to NPS account [Section 80CCD(2)]. A deduction of up to 14% of salary can be claimed.

- Deduction for additional employee cost (Section 80JJA)

- Deduction against amount paid or deposited in the Agniveer Corpus Fund under Section 80CCH(2)

Salary

- Section 80CCD(2) - Employer's Contribution towards pension fund - up to 14% of the salary can be claimed as deduction

- Standard deduction of Rs 75,000.

- Exemption on voluntary retirement 10(10C), gratuity u/s 10(10) and Leave encashment u/s 10(10AA)

- Certain allowances such as transport allowance for specially-abled employees, conveyance allowance for job-related travel, travel compensation for tours or transfers, and daily allowances for duty-related expenses away from the workplace are exempt under specific conditions.

- Perquisites for official purposes.

House Property

- Interest on Home Loan on let-out property (Section 24) can be claimed without any limit.

Other Sources

- Gifts up to Rs 50,000.

- Deduction of Rs 25,000 against Family Pension.

Section 115BAC Deductions & Exemptions Not Allowed

The New Tax Regime disallows most of the deductions. The following are the deductions that are not available under Section 115BAC.

Chapter VI A Deductions

- The deduction under Section 80TTA/80TTB

- Section 80C, 80D, 80E and so on, except Section 80CCD(2) and Section 80JJAA

- Exemption or deduction for any other perquisites or allowances including food allowance of Rs 50/meal subject to 2 meals a day

- Employee's (own) contribution to NPS

- Donation to Political party/trust, etc

Salary

- Professional tax and entertainment allowance on salaries

- Leave Travel Allowance (LTA)

- House Rent Allowance (HRA)

- Allowances to MPs/MLAs

- Helper allowance

- Children education allowance

- Other special allowances [Section 10(14)]

House Property

- Interest on housing loan on the self-occupied property or vacant property (Section 24)

Other Sources

- Minor child income allowance

Business or Profession

- Additional depreciation under section 32(1)(iia)

- Deductions under section 32AD, 33AB, 33ABA

- Various deductions for donation for or expenditure on scientific research contained in section 35(2AA) or 35(1)(ii) or (iia) or (iii)

- Deduction under section 35AD or section 35CCC

- Exemption under section 10AA for SEZ units

Old and New Tax Regime for FY 2025-26 - Comparison of Deductions

The below table outlines the deductions & exemption that are allowed and disallowed under the old and new tax regimes:

| Deduction/Exemption | Old Regime | New Regime |

| Section 80C (Investment in PPF, NSC, Life Insurance Premium, ELSS, etc.) | Available up to Rs. 1.5 lakh | Not available |

| House Rent Allowance (HRA) | Available (based on actuals) | Not available |

| Standard Deduction (for salaried individuals) | Rs. 50,000 | Rs. 75,000 |

| Section 80D (Health insurance premium) | Available | Not available |

| Interest on Housing Loan (Section 24) (for self-occupied property) | Deduction up to Rs. 2 lakh | Not available |

| Section 80G (Donations to charitable institutions) | Available | Not available |

| Leave Travel Allowance (LTA) | Available | Not available |

| Section 80E (Interest on education loan) | Available | Not available |

| Section 80TTA/80TTB (Interest on savings bank account/interest for senior citizens) | Available | Not available |

| Professional Tax (for salaried individuals) | Available | Not available |

| Entertainment Allowance | Available | Not available |

| Transport Allowance (for specially abled) | Available | Available |

| Children’s Education Allowance | Available | Not available |

| Income from House Property Loss Set-off | Allowed (set off with other income) | Not available |

| Additional Depreciation (Section 32(1)(iia)) | Available | Not available |

House Property Deductions and Business Losses Under the New Tax Regime

| Deduction / Loss claimed | Old Regime | New Regime |

| Self-Occupied House Property | Interest on housing loan up to ₹2 lakh deductible; loss can be set off. | No deduction for interest; no set-off of loss. |

| Let-Out House Property | Interest fully deductible; excess loss can be set off/carry forward. | Deduction limited to taxable rent; no set-off or carry forward of excess loss |

| Business Loss / Unabsorbed Depreciation | Set-off and carry forward allowed if conditions are met | Not allowed if linked to deductions not available under the new regime.(e.g., Sec. 35) |

| Example: Sec. 35 Deduction Loss | Can be carried forward and set off in future years | Cannot be set off if deduction not allowed under new regime |

Can I Switch Out of New Tax Regime?

The new tax regime is the default tax regime for FY 2025-26. However, taxpayers can opt out and still file taxes under the old tax regime if it is beneficial by filing Form 10-IEA.

| Particulars | Salaried Taxpayer | Non-Salaried Taxpayer |

| Opting out of New Tax Regime | Allowed | Allowed |

| Action required | Choose Old regime while filing ITR | File Form 10-IEA |

| Form 10-IEA applicability | Not applicable | Mandatory |

| Form 10-IEA filing frequency | Not required | Once (valid for future years) |

| Switching back to New regime | Allowed anytime | Allowed only once in lifetime |

New Tax Regime Calculator

Use ClearTax Income Tax Calculator and assess your tax liability and tax savings under the New Tax Regime for FY 2025-26 and FY 2026-27.

Income Tax Calculation Under New Tax Regime

Mr. Rakesh has a salary income of Rs. 25 lakhs for FY 2025-26 (AY 2026-27)

The taxable income of Mr. Rakesh for FY 2025-26 under the new tax regime will be calculated as follows:

| Particulars | Amount |

| Income from Salary | 25,00,000 |

| (-) Standard Deduction | -75,000 |

| Taxable Income | 24,25,000 |

The tax liability of Mr. Rakesh will be as follows:

| Tax Regime | Tax Liability |

| New Tax Regime | 3,19,800 |

| Old Tax Regime | 5,69,400 |

By opting for the New Tax Regime, Mr. Rakesh will be able to save Rs. 2,49,600 in taxes.

Also Read:

1. Income Tax Slab For Women FY 2025-26

2. How To Save Taxes Under The New Regime FY 2025-26?